Regular readers would know I am not the biggest fan of looking at the money supply and trying to work out inflation or indeed almost anything else from it. I am also not in the habit of getting specific about anything other than banks and regulators. In the US, though, the Fed is both a bank and a regulator and the position they have adopted with regard to the US money supply over the last 6 to 12 months, though, has become ridiculous.

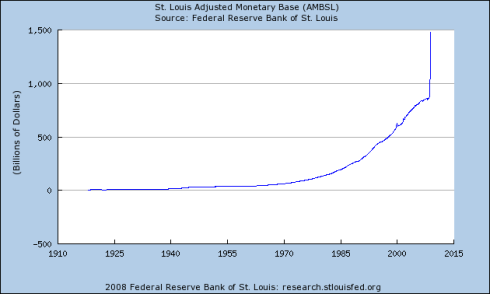

A look at this graph, from the St. Louis Federal Reserve, makes the situation plain.

This cannot be a good thing. Measured money supply has almost doubled over the last 12 months – almost equalling the entire growth over the period covered by the graph in the space of less than a year. It just seems to be experimenting with the entire US economy.

Not being an economist I have no real idea of the effects – but it just looks wrong. I hope most of that is just sitting in bank vaults and not being spent. If so, it should not do too much damage and can be soaked back up by the Fed next year. We’ll see.

UPDATE

I have been pointed at this post, which suggests that the reserves are, as I thought, just sitting in bank vaults – or, possibly, on deposit with the Fed itself. If so then this is less likely to affect the real world. Either way, though, it is very, very, unusual. I am sure there will be whole books written on this period for decades to come – along with some serious revision of economics texts.

73 comments

30 December, 2008 at 02:13

Jesse

Wild Card!!

The strong dollar trend breaks (see the dollar index)

AMB shows massive increase.

Will we see massive inflation soon?

Though the US will see an overall marked increase again soon…. a massive increase now is unlikely (DEC 08). But the stage is set.

5 January, 2009 at 16:50

Robert Townsend

Several things are going on which are not necessarily inflationary. With the introduction of the Glass Steagall, there developed a vast bulk of unregulated credit markets in the USA which were outside of the banking system and not counted in any of the Money Supply numbers – eg all of the securities floating around which were issued by largely unregulated investment banks and held via money market mutual funds.

Secondly much of the liquidity injected by the Fed into commercial banks is simply being passed back to the Fed in forms of collaterised loan holdings. There is little new lending arising out of the Fed’s massive monetary injection. To the extent that the Fed’s actions are inflationary, they may do nothing more than limit the massive asset deflation which might otherwise develop. This the Fed wants to prevent as a deflationary spiral is every economists nightmare.

5 January, 2009 at 17:13

Andrew

Robert,

I would agree. I think it just goes to show that the old ways of measuring the money supply are seriously out of date, assuming as they largely do that there are some entities (called “banks”) that matter and other entities (everything else) that do not.

I would suspect that there will be a huge drop in this graph once interest rates climb back above the effective zero they are at in the US at the moment.

6 January, 2009 at 14:10

Jesse

True Money Supply

http://mises.org/content/nofed/chart.aspx?series=TMS

http://www.mises.org/story/2695

“Of interest too are the sorts of collateral the Fed accepts nowadays from banks in return for loans. The list reads like a Who’s Who of the investment world.”

6 January, 2009 at 15:44

Andrew

Jesse,

If the Rothbard chart is correct then “V” (volume) must have collapsed since 1988, as the money supply, as per that chart, has gone from 1.7Tn to 5.5Tn – more than tripled. I very much doubt the size of the economy has similarly increased during that period, even measured in 1988 dollars.

8 January, 2009 at 01:32

Jesse

sorry? i don’t follow your logic. could you elaborate a bit further.

8 January, 2009 at 01:45

Andrew

Jesse,

According to the chart, money supply has gone from 1.7Tn to 5.5Tn over the period. One of the basics of money supply is that MV=PQ – it is the basic money supply equation – it is a truism.

For this to be the “true” money supply, then it is the “M” of the equation. For P and Q to have gone with their measured amounts over the period, then “V”, the velocity of circulation, must have dropped over the period, i.e. the speed with which money is circulating must have reduced. Given what has happened to reserve ratios and the improvements in electronic banking over the last 20 years I somehow doubt that.

I am not saying it is wrong – I have not done the maths as yet – but I would want to do a really good spreadsheet before I accepted these numbers as correct. I am an analyst from way back and the first rule I always set myself when looking at a question like this is to check and recheck anything that does not make intuitive sense.

10 January, 2009 at 01:06

Jesse

I’m sure your math is fine. It’s economic theory that matters.

Have you ever read Hazlitt’s : Economics is One Lesson?

10 January, 2009 at 14:07

Andrew

Jesse,

I have read (and agreed with) many of the Austrian School economists – but I have not read Hazlitt, as he what he wrote was aimed specifically at the US market. Rothbard is one that I do not always agree with, particularly on his theory of money, which I have dealt with before.

I was just attempting to make some intuitive sence of the graph and I could not do so based on the very basics of monetary economics.

11 January, 2009 at 03:05

Jesse

These are both by Hazlitt

The Velocity of Circulation

http://mises.org/story/2916

What you Should Know about Inflation

http://mises.org/story/2914

This is a newsletter from ’87 that gives an overview of the True Money Supply statisitic

http://www.mises.org/journals/aen/aen6_4_1.pdf

11 January, 2009 at 15:09

Andrew

Jesse,

Sorry for the delay in letting it out of moderation. I am getting a lot of spam at the moment and so have lowered the automoderation limit to two embedded links.

.

Thanks for that – I have looked through the newsletter for a brief overview. It makes alot of sense and I would agree with much of it. However, while many of the arguments in there may have been relevant in 1987 they are less relevant now.

The overall definition of “money” that they are using seems to be “par value claims to immediately available dollars” – it is repeated several times or “the final means of payments on all transactions”.

In 1987 it would have been difficult to get that number, even with the relatively simple (by today’s standards) banking system and they have made a valiant attempt at it.

21 years later, though, the numbers would be a lot fuzzier. For example, they cut out credit cards as they are not “a final means of payment” – but I have a credit card linked to my debit account and so my credit card is a final means of payment. They cut out all term deposits as they are not at call – but I can now break any term deposit at any time, although not necessarily for par – it could be at an amount above par in a rising interest environment.

The exclusion of MMMFs is also, at times, questionable.

My position is that trying to calculate the “money supply” exactly is always going to be a fruitless exercise because trying to get a definition and then to apply it to the huge amount of products out there is going to be impossible – the sort of exercise they did in 1987 to get this number would have to be repeated every time a new product comes out and reviewed for all the old products each and every time – clearly a practical impossibility.

Given that, I prefer to say that the price of money – the yield curve – is the actually usable indicator in the economy as to whether there is too much or too little money in the economy – effectively looking at the second order effect, rather than the first order quantity.

It is a bit of a cop out, I acknowledge, but trying to come up with a usable money supply aggregate just looks an impossibility to me.

30 October, 2009 at 08:30

ABOM

A useful adjunct to this discussion:

http://www.marketoracle.co.uk/Article14627.html

Disagree that M2 (or M3) can’t be considered money for the reasons previously provided (central banks exist to print in cases of systemic risk, so savings accounts are money even in extremis).

However, this is an interesting analysis on the definition of “money”,

30 October, 2009 at 09:30

Andrew

Looks like even some of the people at Mises are taking baby steps towards my ideas of what the money supply is. There are several problems with it – the “credit out of thin air” nonsense is always a good one.

30 October, 2009 at 09:39

ABOM

Given that “the doctor is in” today, what do you think of this?

http://www.newdeal20.org/wp-content/uploads/2009/10/raj-revised-testimony1.pdf

I notice for a risk analyst you’ve said surprisingly little about “weapons of mass destruction” – OTC derivatives. It’s like we’re all living with the Sword of Damocles hanging over our heads, talking about this tiny risk and that tiny risk, when the biggest risk to the whole financial system is left unanalysed, ignored, forgotten about.

What do you think of OTC derivatives?

Should they be forced into a clearing house – a REAL (transparent, third party run) clearning house?

If you favour the “light touch” there too (and I suspect you do), do you support immediate repeal of legal tender laws so I can try to escape OTC derivatives madness (these WMDs wouldn’t exist by the way WITHOUT a monopoly fiat paper/electronic currency. So much for finance being a creature of the “free market”!).

30 October, 2009 at 09:41

ABOM

“clearing house” or “cleaning house”. Either one works. Right now incestuous, balance sheet bulging, bonus making, shell game-like OTC derivatives are neither clear nor clean! Ha ha ha!

30 October, 2009 at 10:49

Andrew

Nonsense, ABOM. OTC derivatives existed long before there even was currency. OTCs existed all the way through the gold standard era and they will exist for as long as there is certainty about the future.

Read just a little economic history, please. That was just embarrassing to you.

30 October, 2009 at 11:48

ABOM

Errr…so the CURRENT out of control OTC derivatives market is no different from the Chicago futures market? Is that what you’re saying??? That’s like saying paper currency existed for hundreds of years so the currency fiat money system is “well established”. Rubbish. What’s embarrassing is that you (1) don’t read the references I put under your nose (2) dismiss REAL risks (unfortunate for a risk analyst) (3) call concern about OTC derivatives “embarrassing”.

More “embarrassment” from trading professionals:

http://jsmineset.com/2009/09/13/mountain-of-otc-derivative-wmds-waiting-to-explode/

http://jsmineset.com/2009/09/08/in-the-news-today-305/

I worry about you. I wonder whether I should get into risk analysis. The current crop are so blind to REAL risks, surely my addition to the profession could only be a net positive?

30 October, 2009 at 15:16

Andrew

ABOM,

A forward contract for the purchase of foreign currency is an OTC derivative. As is a vanilla interest rate swap or a forward contract for a commodity. These are traded thousands upon thousands of times daily. You are claiming that somehow they are “weapons of mass destruction” and need to be banned or traded on an exchange? Get a grip – or loosen it, which ever you are not doing now.

Oh – and read up again before you bother to comment. You clearly have no idea what you are talking about with these sorts of arguments.

30 October, 2009 at 16:04

ABOM

A paper currency can represent a specific amount of gold or silver. Or it can be backed by nothing but a massive unsustainble overconsuming Ponzi scheme.

http://en.wikipedia.org/wiki/Criticism_of_fractional-reserve_banking

Shorting of shares you borrow can be a way of providing liquidity to the stockmarket, enhancing accurate pricing and can be a profitable way to trade shares. Naked shorting combined with CDSs can be a way of murdering a company or country. Those who engage in this practice with a view to driving down the price short term and bankrupting a company are murderers through counterfeiting shares and should be shot through the temple with .44.

http://www.rollingstone.com/politics/story/30481512/wall_streets_naked_swindle/print

A simple forward contract can be a means of covering risk for Treasury depts worldwide. Or can be a way of grossly inflating the “assets” of a bank through incestuous counterparty trades using Other People’s Money, which, when they cannot deliver, results in a cascading series of defaults that threatens to bring down the financial markets.

Reference: Q4, 2008. And this: http://www.eurodad.org/aid/article.aspx?id=132&item=3024

Why do you never provide a single reference to back up your criticism of me, when I provide a reference to back up every single statement I make?

Is this yet another example of an “asymmetrical trade”?

30 October, 2009 at 16:25

Andrew

ABOM,

…or a paper currency can be just an efficient way of storing and transferring value without the need to have warehouses full of commodities just to back currencies. Take your pick – but you will probably not understand the third option.

.

Great – so you advocate capital punishment by execution for people just for carrying out an otherwise legal transaction. Wonderful. Well informed.

.

And how are you planning to tell the difference, ABOM? Your wonderful gun to the head method, or will you be using blood sucking vampires?

.

If you had any links to people and sites that were more than the laughably uniformed you use I may feel the need to. I have much better things to do with my time, though – like earning money or playing with my kids.

30 October, 2009 at 16:30

ABOM

“On Wednesday March 18 1789 one Catherine Murphy, a counterfeiter, was dragged from the debtor’s door of Newgate Prison, and led past the hanging bodies of at least four of her male accomplices. Somewhat unjustly men found guilty of counterfeiting were hanged, while women for historical reasons were burned at the stake.

The disparity of punishment came about it seems because previously the male condemned were drawn and quartered, exposing their breast to public gaze. Naturally it would be an offence to public morality to show female breasts, so they were burned instead.

In reality Catherine Murphy was hanged before being burned, the executioner Brunskill tightening a noose around her neck and letting her dangle for a good 30 minutes before setting light to the faggots spread around her. This merciful adaptation of the method or variations on it had been practised for several decades.

Sometimes, however, the act of mercy failed. Catherine Hayes in May 1726 suffered horribly when the executioner lit the faggots too soon, and was prevented by the rapid spread of the flames from putting the strangling rope previously arranged round her neck to good use.

It was not out of mercy for the condemned that the law was changed to end burning at the stake in 1790, but because the sensitivities of JPs and Sheriffs were offended by the gruesome sight and vile smell of bodies thus treated.”

There is so much to laugh at in this quote it’s difficult to know where to begin.

I start with the fact that demand deposits are money with a central bank ready to print in a systemic crisis and therefore modern banks are simply large counterfeiting organisations – nothing more, nothing less. I end with a comparison of the “admiration” some people have for these creatures (Andrew?) and the fate counterfeiters faced in previous times.

Their “profession” has dramatically risen up the class structure in recent centuries (even more than thieving govt officials, pornographers and spies) …

30 October, 2009 at 16:32

Andrew

…and yet you claim to support free banking. What complete and arrant nonsense you peddle, ABOM. Why do I waste my time dealing with this rubbish?

30 October, 2009 at 16:43

ABOM

Free banking…

WITH THE REMOVAL OF LEGAL TENDER LAWS ALLOWING GOLD AND SILVER TO FUNCTION IN THEIR GOD-GIVEN ROLE AS NATURAL MONEY.

I have to capitalise in the hope that you’ll process this information accurately, because Lord knows you haven’t in the past.

30 October, 2009 at 17:47

Andrew

…and yet you call FRB counterfeiting. Go figure.

30 October, 2009 at 17:56

Alice

Im with ABOM – why arent we FREE to use gold and silver as currency Andy????

Why do you support regulation that disallows these as legal tender Andy. I thought you were the great de-regulationist but you are just a biased bwanker and I would go so far as to say that you have no real economic beliefs except supporting whatever is advantageous for banks.

The least you could do is support me over at JQs arguing that “Nathan Rees Loser” and every other politician in the damn country is taking a nice little ride with the rich by making sure theor salaries are in not the top 20%, not the top10% not the top 5% but the top 0.5 of a percent.

How did these wankers become so damn rich? Now I know why everything they do in politics is for the ealthy few .

WE ARE DOOMED ABOM. THE GOVT IN THIS COUNTRY IS F*****ED and working with the wealthy only (we havent go a chance of getting decent policies in anywhere – its everyman for himself and the farm looks great) I dont even swear normally but Ive had it with incompetent corrupt politicians their fines, fees and charges and NO SERVICE AY ALL except to enrich themselves by selling what was once publicly owned.

I say we vote anyone BUT labor and liberal. I say we vote for donkeys or monkeys because it would be an imrpovement on all of them.

30 October, 2009 at 18:05

Andrew

Alice,

Where have I ever said I am in favour of such legislation? You make such incredible leaps at times.

In fact, there is nothing that says you cannot use these as currency – just that fiat is legal tender. There is nothing at all to prevent you from agreeing to use gold, silver, copper or, for that matter, hot air to settle your debts.

.

As for politicians, you are the one saying they should have more power, not me. Sort out your own argument first.

30 October, 2009 at 18:12

Alice

Well I didnt know hpow much the bastards were paying themselves and now I do Im furious. No wonder we cant get decent policies and decent management from Givernments. They are too busy hobnobbing with the other bastards in the top 0.5% of the population.

How dare they Andy? They are hardly entrepreneurs and I am paying the bastards and they do nothing. NOTHING.

No wonder Andy – I know why they dont work – its as clear as a bell. They trhink they are important. Too important to consider the real and average Australian. Im angry Andy. I honestly didnt know how much those D****heads had increased they pay relatively over the years.

30 October, 2009 at 18:32

Alice

Well Andy – for once Ill agree with you. The people need more power to throw them out at State and Commonwealth level and reset the damn pay levels. We are not getting value for our taxes.

30 October, 2009 at 20:09

ABOM

A huge portion of US taxes go to pay interest on debt which was created out of nothing by the central bank to “lend” to the US govt. The whole govt is just a coercive tool to suck resources from one (productive) group to give to another (parasitic) group – international bankers. The whole thing is a game. A set up. A JOKE.

If it wasn’t so, then the money supply in the US would NEVER have exploded (to save corrupt stupid bankers). When do you or I get a billion dollar bailout if our business goes bust? NEVER! Why did the bankers? Because THE WHOLE GOVT IS SET UP AS A FRONT TO THIEVE FROM YOU AND ME AND OTHER PRODUCTIVE WORKERS.

The most efficient form of govt is none at all. I wish it weren’t so, but unforunately parasites always find a way to infiltrate monopolies and there’s no bigger monopoly than a monopoly of force (govt) and a monopoly on the means of exchange (central banks and govts).

We are all buckling under the debt death march these slave owners are subjecting us to. And when they get into trouble – check out the graph – the central bank prints to bail them out.

Where is justice in this life?

Perhaps there will be justice in the next. If there is justice every banker in the world today is going straight to HELL.

30 October, 2009 at 20:11

ABOM

Multiple comments of mine are stuck in limbo. Don’t know whether Andie is playing God or just preoccupied.

31 October, 2009 at 07:03

Alice

Andy – what are you doing to ABOMs posts/ I agree ABOM. They only need to look at PRIVATE sector debt levels to know we are on the debt death treadmill and its been rising and rising for a couple if decades now

but its like underemployment and unemployment isnt it ABOM? Its an indicator they (politicians) have blatantly choosen to ignore while they sit on their well paid thrones courting every other like minded soul, while inventing more fees, more tolls, more fines, more cameras, more restrictions, more shonkly deals, more nanny state proclamations, more and higher user charges

While we run and run on that death debt treadmill. Something tells me private sector debt is going to blow up their obscenely exclusive and cosy little party ABOM.

31 October, 2009 at 07:04

Alice

And when every banker goes to hell ABOM they can take every fat bureacrat with them. They belong together.

31 October, 2009 at 11:44

Andrew

No, ABOM, you are just being boring and repetitive. Please come up with something that is actually worth saying or go away.

31 October, 2009 at 11:59

ABOM

Is this worth saying?

It’s been on moderation for a while (5:12pm, 30 Oct 2009) and has multiple references.

“or a paper currency can be just an efficient way of storing and transferring value without the need to have warehouses full of commodities just to back currencies. Take your pick – but you will probably not understand the third option.”

You old Ricardo and Adam Smith arguments bore me and disgust me. To accuse me of not undertanding their arguments just twists the knife.

Old pathetic arguments – paper costs less than gold to produce, money is a medium of exchange so paper is superior to gold. Gold is “old” money. Paper (and now e-money) is “modern” money.

Counterarguments:

(1) To “manage” e-money there are today thousands and thousands of useless govt employees in central banks all around the world, trying to outdo the Soviet Union in central planning. The annual DIRECT expenditure on all the buildings, employee benefits, travel expenses, etc etc of the central banks of the world (including BIS) exceeds the annual production cost of gold in Australia and China put together (roughly estimated).

(2) Cost of employing economists, analysts, commentators in banks and govt consulting etc is massive. Add this plus central bank expenditures and associated govt expenditures to control and monitor “paper fiat money” and it would amount to over double the annual cost of gold production worldwide. If gold was money, estimates of increases in the money supply would be remarkably straightforward involving simple projections of mining production and jewellery usage.

The “cost” savings moving to gold as money would actually be immense.

(3) e-commerce would allow gold to be traded on-line, allowing very efficient storage costs and transfer. There is no reason why gold could not serve as modern money today. e-gold and bullionvault are already experimenting with these systems.

(4) the immense costs of lost production, lost lives, lost socities through bank-credit created business cycles is incalculable. These only really occurred AFTER the installation of central banks (please don’t bore me with stuff about the 19th century – I’ve read it). The “savings” here in moving to gold would be incredible.

I would have thought this was (1) relevant (2) new (3) “worthwhile” given its relevance.

However, we do come from different planets (me: genuine free markets; you: monopoly fiat and central banking with some strange reference to “free markets” thrown in the backend), so your understanding of “worthwhile” is likely to be very different from mine.

31 October, 2009 at 12:07

ABOM

YouR old Ricardo and Adam Smith…

You may be woefully outdated in your analysis of modern finance, but I didn’t intend to accuse you of being “old”.

Profuse apologies.

And the remaining comment on moderation is a doozy. I can understand you wanting to censor it.

Then again it is the logical outgrowth of an analysis of FRB as counterfeiting so I don’t regret or retract it. You can take it off moderation ot kill it. You decision.

And, yet again, a pro-banker is reduced to censorship, rather than continuing to argue on the merits (with references). I have no more opponents. Banned from WP. Banned here.

Is there any banker willing to stand up and fight with me toe-to-toe?

31 October, 2009 at 12:25

ABOM

My typing skills are deteriorating with my mood.

“Your decision”.

With the kind of widespread “brick-wall-get-f*cked-style” rejection of my concerns regarding the stability of the current insane pure fiat-FRB-central bank-dominated financial system (and the economy more broadly), I KNOW we’re ALL screwed. 99% certain.

A point will come when the environmental damage from bank-credit-sourced over-consumption will become so bad that whole categories of food source will collapse within months.

Tuna fish are probably next. Then other fish. Then bee-pollinated fruits and legumes. Then meat (from high feedstock prices caused by a massive spike in oil prices and competition from humans for feedstock). Then even wheat and sugar due to GM stuff ups, disease and poor farming practices.

It won’t be the price that adjusts. It will be a catastrophic collapse in volume.

Overfishing in the late 20th century throughout the world is the model that will apply across the human food chain in the next 20 years. Everyone knows overfishing is insane and suicidal, but the most sophisticated, advanced societies in the world (EU, US, Aust, SE Asia) can’t seem to stop it. Fish stocks are collapsing. Whole categories of fish have been wiped out in European waters. It’s madness. And yet it’s happening before our very eyes. We can’t seem to help ourselves. The fishermen and IN DEBT, they have to drag resources out of the sea to live themselves, the bankers won’t cancel the debts. We all end up with no fish due to the indebtedness of the fishing industry and lack of real savings in society. Caused by….caused by….caused by? FRBanks!

If you think govts and bankers can handle other areas of the food chain better than this, then you’re crazier than me.

Banks and govts are pushing us literally towards extinction. It’s tragic – but so obvious and so stupid and so unnecessary, it’s almost funny to watch.

Almost.

http://www.lewrockwell.com/orig10/evans-pritchard10.html

31 October, 2009 at 16:03

ABOM

A clarion call for sanity, eloquently expressed…

http://www.cnn.com/2009/OPINION/10/30/ron.paul.fed/

But is it too late?

Sadly I believe so.

31 October, 2009 at 16:18

ABOM

Hyperinflation or depression?

http://www.marketoracle.co.uk/Article14674.html

The timeless Makian Distribution Dilemma, once you cross the unseen Rubicon of “too much private and public debt”, once the misallocation of resources through embezzling FRB becomes too great to defer for another decade.

The Day of Reckoning for Banking Embezzlers Worldwide is Fast Approaching.

I vote stealth inflation. But who knows?

31 October, 2009 at 16:38

ABOM

“Nobody was more surprised that the general public did not discover the US government’s and the Fed’s Ponzi scheme years ago than the Treasury and the Fed themselves.

After all, it would have been pretty simple, they said in a transcript of a jailhouse interview after the Revolution successful confiscated their property and discovered scores of incriminating documents showing the extent of the worldwide financial Ponzi scheme, sustained only by ever-increasing amounts of public and private debt.

In the interview, Mr. Ben Bernanke said that the young investigators who pestered him over incidentals like e-mail messages during the Fed Audit should have just checked basics like this website:

http://www.usdebtclock.org/

“If you’re looking at a large Ponzi scheme, it’s the first thing you do, check the level of unsustainable public and private debts” he said.

http://www.nytimes.com/2009/10/31/business/31sec.html?_r=1&hp

31 October, 2009 at 18:01

Andrew

Looks like you are desperately trying to get as many thousands of looney links out as you can before I ban you.

No need to be too desperate, ABOM – but I cannot help you on the links. They really are not worth the time any more.

31 October, 2009 at 18:06

Andrew

Oh, and if you want a link:

http://steveedney.wordpress.com/2006/09/26/misbehavior-of-markets-mandelbrot/

31 October, 2009 at 20:53

ABOM

Censorship doesn’t cut it as a coherent argument, but is good for one’s mental health.

And one more “looney” link for you:

“…In a 2002 study published by the U.S. National Academy of Sciences, a team of scientists concluded that humanity’s collective demands first surpassed the earth’s regenerative capacity around 1980. As of 2009 global demands on natural systems exceed their sustainable yield capacity by nearly 30 percent. This means we are meeting current demands in part by consuming the earth’s natural assets, setting the stage for an eventual Ponzi-type collapse when these assets are depleted….”

Lester Brown, Plan B 4.0

http://www.earth-policy.org/images/uploads/book_files/pb4book.pdf

I hope you enjoy playing with your kids. If you cared for them more, you’d be more concerned about the links I’ve carefully provided. Because it shows the world they’re gonna live in.

31 October, 2009 at 21:44

ABOM

And just on your reference, yes, I’ve read it. I never dismiss anything you write, as long as it’s referenced. Fortunately, that’s fairly rare in your case.

I attended a Chaos Theory seminar at UNSW in 1991 and asked Mandelbrot some questions during the seminar. I was interested in Chaos Theory because of my interest in subjectivist probability analysis arising from my Honours Thesis on James Buchanan’s analysis of probability theory (which, by the way, wasn’t very good – the whole thesis was a critique of JB’s analysis). I’ve met JB as well by the way. Slightly more impressive than Mandelbrot, but still not a stunning mind by any means. Workmanlike. No Rothbard. Certainly no Mises.

Mandelbrot didn’t impress me either. And, equally, I didn’t seem to impress him. At all.

I asked him about Chaos Thery in financial markets, implying that prediction and planning was inherently subjective and therefore incapable of being modelled. He stared into space and mumbled something incoherent. It was a distinctly deflating moment, as he was a something of a hero prior to my attendance at that seminar.

I like Taleb slightly better, but even he doesn’t quite seem to “get it”.

The one key insight on risk that I can provide before I die:

Increasing debt levels (with FRB) bring about increased volatility, with the long-term mean growth rate being one of the LEAST LIKELY outcomes in the late Minsky Ponzi finance stages of financial “innovation”. I dispute Taleb’s idea that exogenous “Black Swan” events come out of the sky on a more than normal distribution semi-regular basis, and knock the normal distribution of prices out of whack, so there is no normal distribution. The problem with Taleb is that he doesn’t replace the bell curve with anything else. He just says “Watch out, the bell curve doesn’t work! These quantitative risk analysts don’t know what they’re talking about!” Yeah, but what do you use INSTEAD?

My analysis is that this is an ENDOGENOUS dymanic process occurring, and fairly predictable and fairly easy to model.

I picture this endogenous process as a bifurcation of the bell curve distribution, resulting in what looks like a Levy-type distribution over the long run. But just looking at data points for the last 100 years doesn’t cut it – you have to correlate and compare the returns with debt levels for market participants. The long run data actually “hides” this bifurcation.

This bifurcation occurs suddenly, crystallising when new “suckers” cannot be found to go into debt in sufficient numbers to pay off the debts that have already been accumulated. Late comers have to liquidate, or the central bank has to inflate. Two extreme outcomes on the “normal curve” which no longer exists. It has been taken over by bifurcating bell curves – an M shape I call the Makian Distribution.

If you actually track the “exteme” price points in the historical data Mandelbrot tracks to show the normal distribution doesn’t work, they are invariably points of high stress in the markets – points of high leverage, high use of margin trades. It’s not so much that the normal curve doesn’t work at all (it does OK during “normal periods” or over the long term). It’s that it doesn’t work during periods of high leverage or high debt, when volatility goes “crazy”.

Everyone seems to want to try to get a distribution (Levy, normal etc) to “timelessly” fit the data, that works “all the time”. It doesn’t work that way. There is a correlation between volatility and debt levels, so the shape of the distribution must change depending on the levels of unsustainable debt.

The M-shaped Makian distribution is my way of picturing the probability distribution during these periods.

References:

http://forum.globalhousepricecrash.com/index.php?act=attach&type=post&id=4127

And this from Mises, who essentially said the same thing, but without the bifurcating bell curve idea:

“Certainly, the banks would be able to postpone the collapse; but nevertheless, as has been shown, the moment must eventually come when no further extension of the circulation of fiduciary media is possible. Then the catastrophe occurs, and its consequences are the worse and the reaction against the bull tendency of the market the stronger, the longer the period during which the rate of interest on loans has been below the natural rate of interest and the greater the extent to which roundabout processes of production that are not justified by the state of the capital market have been adopted.”

http://www.goldensextant.com/SavingtheSystem.html

One PRACTICAL outcome coming out of this analysis: Put and call options during periods of high leverage (particularly put options) are woefully underpriced because most market participants are using the Black Scholes method which in turn uses the normal distribution.

A great way to make loads of money using this theory right now: Leverage up on Australian bank shares. Buy put options exercisable in 12 months at 10% below the current price. The yield will cover the interest. If they fall, exercise the put as insurance. The put will (generally) be underpriced, based on the real distribution of returns (which in banking during periods of high stress turns Makian quickly and could turn Makian again as early as 2010).

I’ve been banging on about this for over 20 years now. First in my Honours Thesis. Then on WP (banned). Now here (banned again).

Seriously, is me? Is it something I’m wearing? Do I smell bad? What the Hell is wrong with me?

Is it because I predict catastrophe (like Mises) that causes people in finance and in mainstream economics to hate me so?

I do see a direct correlation between FRB and environmental and economic catastrophe, so perhaps that’s it. Anyone engaging in FRB probably doesn’t want to hear that it’s a gigantic PARASITIC PONZI SCHEME that’s about to collapse, big time.

1 November, 2009 at 07:56

Alice

ABOM – you are right. I dont want my money in the financial markets or the banks. Each share market crisis is getting exponentially bigger (but seeming to bounce back quicker) but whats underneath it is something even more insidious and there must be a true correction. The volatility isnt over until there has been a real wipeout of the inflated values.

The big one hasnt arrived, I dont think.

You are right re Taleb. He only parially has it. These are not one off “black swan events”. They grow on a track of their own. I agree with you.

1 November, 2009 at 11:05

ABOM

Agreed. The BIG ONE is yet to come. I see the outline of the tsunami on the horizon. It looks like a sharp reduction in US output as the ridiculous stimulus spending packages dry up, then a stockmarket correction, then a spike in oil and gold, then a US debt crisis. Then…who knows?

1 November, 2009 at 11:22

Andrew

ABOM,

As I have said before- there are many problems at the heart of your argument. I have pointed them out time and again and all you have done is to bang on regardless. Come up with something interesting and relevant and stop with all this Ponzi crap. You know it is (as you support free banking, or claim to) and yet you keep banging on about this idiocy that you cannot see the difference between a Ponzi scheme and a bank. If you are not bright enough to know the difference there is very little help I can be to you.

1 November, 2009 at 11:26

ABOM

“It should be clear that modern fractional reserve banking is a shell game, a Ponzi scheme, a fraud in which fake warehouse receipts are issued and circulate as equivalent to the cash supposedly represented by the receipt.”

Murray Rothbard

http://www.marketoracle.co.uk/Article14123.html

At least I back up my arguments with references.

1 November, 2009 at 11:36

Andrew

Oh, and if you insist on some links (or you believe that Appeals to Authority have some real merit), try this:

http://www.independent.org/publications/tir/article.asp?a=91

this one:

http://www.independent.org/publications/tir/article.asp?issueID=21&articleID=244

.

Or you could just think through the issues for yourself. You seem to find it better to let guys like DeSoto and Rothbard do your thinking for you, while paying lip service to freedom.

1 November, 2009 at 18:32

ABOM

Don’t you find it amusing that White (a BIS economist) wrote in a publication called “Independent”?

Selgin is a strange dude. Stranger than me. Although I have always supported free banking, with the removal of legal tender laws. To say FRB ecourages saving is beyond me. It encourages speculation. Whether you allow it in a free market (Selgin) or don’t (Rothbard) is a marginal question, which I’ve debated before elsewhere. However to say FRB encourages saving is just crazy.

I do think through the issues myself. Then reference works I find illuminating.

1 November, 2009 at 22:31

Andrew

and then you go off about FRB as if all of the free banking crowd were criminals and deserve to be locked up? I still cannot see how you can claim to support free banking and yet regard free bankers as criminals.

1 November, 2009 at 22:42

Andrew

Selgin is right – free banking must encourage saving. It is very simple to see. Rothbardian banking imposes a cost on those seeking demand access to their funds – you simply cannot save using a demand account without paying substantial fees. Free banking, OTOH, allows for the payment of interest on demand accounts, something that is not commercially possible where FRB is banned (if, of course, it could be).

I would not have thought this controversial.

2 November, 2009 at 08:48

ABOM

Selgin and the FRB-supporting crowd have got it backwards. It’s embarrassing I have to explain this stuff, but here goes (again).

There would be dramatic general DEFLATION in a fullRB environment. Even AFTER the payment of fees, real returns on real savings (“the storing of money for a rainy day” – what Keynesians derisively call “hoarding”) would be positive.

We would be back to the good old days where savers made a decision whether to put gold coins in the bank or hoard them at home based purely on safety concerns, not “returns on investment”. Gold would yield a deflationary return at home or at the bank, as it has done through the centuries.

To say the pitiful interest on savings today compensates for the killer inflation in housing in Australia is laughable. FRB destroys the incentive to save through the production of GENERAL EXPONENTIAL HOUSING INFLATION THROUGH FRB.

The “real returns” on savings in a bank in Aust is MASSIVELY, INSANELY negative when housing has gone up on average around 7% per year for the last 40 years. It makes much more sense to “speculate” and negatively gear into an appreciating property. Until the Ponzi scheme collapses at least.

Do you really believe the stuff you’re spouting or are you just playing me for a fool?

2 November, 2009 at 09:27

Andrew

Again, ABOM, nonsense. You are using the returns on a single investment class (residential property) as if it were the only investment at all? Then trying to say the sins of inflation under a pure inflationary fiat scenario are somehow the fault of fractional reserve?

Twaddle – and if you have the qualifications you claim to have you should know much better.

Inflation was, for all intents and purposes, zero under the old gold standard. It is not FRB that drives it – as one of the links I gave you went through exhaustively.

Twaddle and nonsense. That all you have?

2 November, 2009 at 09:52

ABOM

Andrew, calm down. You know I’m right. Look at the numbers.

(1) CPI is a joke. Housing isn’t in there.

(2) Housing is (BY FAR) the biggest expenditure families make in Australia. Therefore that’s the thing you focus on when talking about inflation – unless you’re a mainstream economist in which case you are beyond hope.

(3) That “single investment class” is the “investment” item (I would argue “the consumption item”) most important to most Australians.

(4) Housing inflation is direct result of FRB. Direct. Read Michael Rowbotham, The Grip of Death. I won’t argue the point UNTIL you’ve read Rowbotham. It’s pointless arguing with someone who doesn’t read the references I make the effort to point to.

(4) Inflation wasn’t zero under the old gold standard. In 19th century USA it was slightly negative for the free banking period.

And some bank, somewhere, thought putting an oil rig in the middle of pristine fishing waters was a good idea. Now it’s a “national disaster”, underplayed by the news networks (censored by govt and the oil companies no doubt). Peter Garrett could not sell out any more than this. His soul will burn in Hell for not speaking out on oil “development” in Australia. What happened to beds are burning? His bed is.

http://news.ninemsn.com.au/national/925626/oil-rig-fire-national-emergency

How many more environmental disasters do we have waiting for us, in the name of “economic development”?

I’m counting the lost fish, the lost protein, the food we cannot afford to waste. And the numbers are looking scary. One of us is going to starve. I think it’s going to be me, sadly, because I can’t fight the machine.

2 November, 2009 at 09:59

ABOM

And I know this is a little off-topic, but how the Hell does a no-nothing Thai oil company get to drill for oil in Australian waters? What environmental and engineering record do these people need to have in order to be given this licence?

The govt gave the licence. They have destroyed our natural asset. By selling out our virgin waters to a Thai company that clearly does not know what they are doing.

FIRB is worthless. Why do we even have a govt again? To protect us from foreign invaders? Ha Ha Ha! Whilst our sodiers die thousands of miles away in Afghanistan, oil kills our own fish from a Thai oil rig in our own waters!

Govt is the enemy of the people. They are worse than useless.

2 November, 2009 at 10:04

Andrew

With your point 5 (the second 4) you just undermined your whole “FRB is inflationary” case. All gone – The US on the gold standard, free banking (i.e. fractional reserve) and no inflation. Thanks very much. Pity it directly and utterly contradicts your other point 4 – now I do not need to read him as you just sank him.

.

Now – savings under Rothbard banking would be lower as the returns to saving are lower. It really is that simple.

Let’s look at a scenario – I can save with a bank and earn even 1% over the return to holding cash (whether negative or positive) through having a demand account. Ceteris paribus does that make me more or less likely to consume or save? Again, everything else is equal, yet I can earn 1% over the return to holding cash. Will I save more or less?

2 November, 2009 at 10:16

ABOM

Can you calm down please. I said FRB is inflationary WITH A CENTRAL BANK. I never said FRB was inflationary in a free banking environment. What I wrote was this:

“May I remind you that we DO have a central bank, that they DID print like there’s no tomorrow in Q4, 2008, that gold is spiking above US$1000 (inflation anyone?), and that Steve Keen has impeccible empirical evidence to show that M0 trails M3.

After 300 posts, your argument is (essentially) that IN THE HYPOTHETICAL, if we had no central bank (i.e. in the La La Land that I dream of when I dream of free banking) FRB is NOT inflationary. Yeah, OK. So what? OK, we agree on that irrelevant hypothetical.

But in the REAL WORLD, today, it IS inflationary. Steve Keen has proven it. I have explained the process NUMEROUS times now.

Why would you use a HYPOTHETICAL world without central banks that hasn’t existed since 1693 to refute my (and Steve Keen’s) realistic, sober analysis of modern banking?

To sum up:

(1) In the tiny corner of AR’s “hypothetical world”, in outer space, FRB is not inflationary if there’s no central bank (la la land free banking world).

(2) If there IS a central bank prepared to print, and if the bankers come crying mommy in a bank run and M3 dives down to M0, INVARIABLY money is printed and the M3 loan generation process creates money at that point. Given IN THE REAL WORLD central bankers ALWAYS print to save their friends, deposits ARE money.

QED.”

So in free banking, there is the real chance that FRB is no inflationary long term. I said it before. I’ll say it again. Why do you not process this information accurately?

Australia (and some damn banker’s) shame…

http://blogs.crikey.com.au/northern/2009/10/26/australias-shame-the-timor-sea-oil-spill-disaster-in-pictures/

2 November, 2009 at 10:19

ABOM

not inflationary.

I’m depressed about the oil spill. Can’t read or type anymore. Humans are so selfishly, mindlessly stupid we deserve to die.

2 November, 2009 at 10:29

Andrew

If I am in “la la free banking world” then where is Rothbard? It would have to be somewhere loonier than la la land as that one is far more extreme as it has never ever even worked anywhere.

Free banking has worked, did work and produced a stable low inflation environment. Why are you bothering with Rothbard and all the anti-FRB stuff when you know it is wrong?

2 November, 2009 at 11:11

ABOM

I’ve never had a problem with free banking. I just think it’s not going to happen in my lifetime.

I agree that “Socialism is a philosophy of failure, the creed of ignorance, and the gospel of envy, its inherent virtue is the equal sharing of misery.” Winston Churchill

I also argue that “Central banking has no philosophy, other than the mindless protection of parasitic Ponzi-bankers, it lives only on a general ignorance as to the true causes of inflation, and is the gospel of parasitic monetary privilege, its inherent virtue is the equal destruction of world currencies to privilege the tiny few.” ABOM

2 November, 2009 at 12:11

Andrew

So why do you tee off at FRB when you know that is not the problem?

2 November, 2009 at 12:35

ABOM

I tee off on Ponzi schemes too. Even if everyone knows it’s a Ponzi scheme and voluntarily participates.

I tee off on gross, barbaric environmental damage too, even though everyone knows what’s going on and approves.

I tee off on teenage prostitution even though the arrangement is (ostensibly) consensual.

FRB is problem when combined with central banking. FRB is even a problem in a free banking environment because it’s not sustainable (doomed to bank run hell at some stage).

Disapproving of something because it’s inherently unsustainable, or immoral, doesn’t necessarily mean it should be illegal, or that it doesn’t confer certain benefits on the participants.

I just don’t necessarily want it to occur in front of me, or when I’m having breakfast. These things tend to make me sick.

2 November, 2009 at 12:37

Andrew

Sorry, but how does that logicall flow from “I’ve never had a problem with free banking”?

2 November, 2009 at 12:45

ABOM

I never had a problem with the removal of legal tender laws and free banking.

I don’t support abortion but will fight (fight!) to allow it as a woman’s choice.

What is inconsistent with that?

I support free banking, but consider FRB inherently analagous to embezzlement and has aspects very similar to Ponzi schemes.

To use another example: I’m not interested in Ponzi schemes, don’t approve of them, but will fight (fight!) to allow people to voluntarily participate in a Ponzi scheme if (1) they know it’s a Ponzi scheme and (2) want to volunarily participate anyway.

That’s what living in a free society really means – allowing ANY voluntary (victimless) activity to occur even if you don’t approve of it. Drug taking, prostitution, FRB, Ponzi schemes, speeding (as long as it doesn’t result in an accident), pornography, blasphemy…

I support free banking. I don’t personally approve of FRB but am realistic enough to know it will go on in a free banking environment and can tolerate that (I won’t be tap dancing on tables, but I can live with it).

What’s the problem?

2 November, 2009 at 13:46

Andrew

and yet you say they are criminals and should be locked up. Odd. As you cannot see the obvious here we probably should move on.

.

On to the Ponzi scheme thing. If you accept Rothbard’s word, then even allowing FRB at all hurts everyone, as it is inherently inflationary – something you have said it is not.

That, to me at least, means you do not accept Rothbard, yet you call FRB “Ponzi”, based on his analysis. If it is not inflationary then it is not a Ponzi – and vice versa.

2 November, 2009 at 16:33

ABOM

I’ve come to the considered conclusion that I don’t like you. You wilfully misrepresent my sublte, multi-facted (but NOT INCONSISTENT) position (clarified above). You denigrate me and my sources. You find inconsistencies where there are none. You move on from one clumsy mistake – without pausing to apologise – to attack me on another perceived “gap” in my argument – which is not a gap so much as your blindspot.

I’m used to getting no respect, but this is ridiculous!

Bankers are borderline criminals in an ethical sense. They are certainly, unquestionably criminally immoral with inflating central banking supporting them. In this case, they are no different from Mao or Roosevelt or Stalin or any other insane power-crazed monetary dictator. They kill and dispossess vast swathes of the human population. They are the source of most environmental and economic catastrophes. Source: Michael Rowbotham, The Grip of Death. Ellen Brown, Web of Debt. http://www.webofdebt.com/

And this cartoon, which even you could understand (yes?):

They are like common shysters or scammers in a free banking environment. “Get one dollar – get one for free! We’ll throw in steak knives with your credit card application! Roll up roll up for our bank notes, accepted by stores in this area (at least for the next week before we go bust and run to Zurich!)”

Doomed to blow up, roaming from town to town, monetary gypsies hoping that their reputation doesn’t precede them (as occurred in the Middle Ages).

Whether they are criminalised (Rothbard) or not (Selgin) doesn’t concern me – they would be marginal, Mafia-style figures, like pimps, hookers, drug dealers, loan sharks. Parasites will always exist, even in anarcho-capitalism. They just wouldn’t be as prevalent (or as prominent) as they are now. Today they run most Western govts, which is very scary and why I cry at night, am suicidal and see oil destroying the seas off NW WA and off Indonesian shores RIGHT NOW. (Death, come painlessly and swiftly and take me away from this monetary HELL HOLE).

I’m tired of repeating myself and am seriously suicidal today. The Mises Institute hasn’t even acknowledged receiving my LLM thesis on international war crimes tribunals and presumably won’t ever publish it, so to say I’m feeling down would be to understate my current state of mind.

You don’t seem to read my references, which is even more disheartening. Perhaps your ears are more receptive than your eyes?

http://mises.org/media/4014

Brilliant. Clear. The best summation of my arguments I can find. Hulsmann is my God.

Who is yours?

On the Rothbard thing, I have a more slightly more subtle (independent?) take on FRB in a free banking environment. It would be temporarily inflationary on the upside but it would be strongly deflationary on the (catastrophic?) downside. So net net, it wouldn’t really be inflationary in the long run. As long as the music is playing and the game of monetary musical chairs is on for young and old, then prices WOULD be rising (in whatever Tulip Bubble area that is fashionable in that moment). So on this side of the cycle, Rothbard is technically correct – FRB is inflationary.

But it would (of course) reverse suddenly at the end of the FRB-induced bubble, provided there is no criminal Central Bank to play mommy and bail out the embezzling idiots when M3 dives down to M0.

Hulsmann explains this very simply in his audio lecture.

You keep nibbling away at my ankles, getting nowhere. Sometimes it tickles my intellect. Sometimes it’s just damn annoying.

2 November, 2009 at 16:41

ABOM

Please take my comment off moderation before I die. And I’m not the only one who has worked out what the Hell is going on:

http://www.dailyreckoning.com.au/inflation-is-evident-if-you-just-follow-the-money/2009/11/02/

Follow the money…into the pockets of the corrupt govt. Worse than the Mafia. At least the Mafia leaves you alone when they steal from you. The govt institutionalises theft and keeps coming back and back and back and back.

F*ck them and their oil spill and their fake money.

2 November, 2009 at 19:19

Andrew

Yes. You are uniquely brilliant and only you could possibly guide us into the light. :)

2 November, 2009 at 19:24

Andrew

Oh – and on the voice. Hulsmann makes a lot of sense until he goes off on FRB. Hayek was much, much better.

2 November, 2009 at 20:10

ABOM

I’ve referenced virtually every statement I’ve ever made, so I’m humble enough to know I need to reference my thoughts with other academic works. Unlike you. You were (above) encouraging me to “think for yourself” (i.e. don’t bother looking up references) and you don’t bother to reference your thoughts. Who’s the egotist again?

I’ve also repeatedly mentioned my pathetic failings and that my powers of persuasion have proven to be worse than Helen Keller’s.

And I’m not leading anyone into anything. We’re ALREADY doomed.

http://www.overpopulation.org/consumption.html

I really don’t think you process reality accurately. Which is worrying for a risk analyst. Then again, neither do our govts, the bankers, most corporations, and the stupid lumpen general populace, so you’re certainly not alone.

2 November, 2009 at 20:30

ABOM

Get ready to oscillate (yet again) into the left hand side of the Makian Distribution. We’ve been on the right hand side for 6 months or so. Last year we were on the left side.

It’s a monetary rollercoaster and no one can escape.

First, deflation. Then inflation. Then deflation. The inflation. Then deflation. Then….BANG. Weimar. Here. We. Come.

All the King’s Horses and All the King’s Men Couldn’t Put Monetary Humpty Together Again.

3 November, 2009 at 10:59

ABOM

“Just men regard repudiation and spoliation of citizens by their sovereign with abhorrence; but we are asked to affirm that the Constitution has granted power to accomplish both. No definite delegation of such a power exists, and we cannot believe the far-seeing framers, who labored with hope of establishing justice and securing the blessings of liberty, intended that the expected government should have authority to annihilate its own obligations and destroy the very rights which they were endeavoring to protect. Not only is there no permission for such actions, they are inhibited. And no plenitude of words can conform them to our charter….

Under the challenged statutes, it is said the United States have realized profits amounting to $2,800,000,000…. But this assumes that gain may be generated by legislative fiat. To such counterfeit profits there would be no limit; with each new debasement of the dollar they would expand. Two billions might be ballooned indefinitely to twenty, thirty, or what you will.

Loss of reputation for honorable dealing will bring us unending humiliation; the impending legal and moral chaos is appalling.”

You know, it’s funny. I look at this quote. Then I look at your graph. This quote. The graph. This quote. The graph. This quote. The graph.

http://www.lewrockwell.com/hornberger/hornberger169.html

3 November, 2009 at 12:39

Andrew

ABOM,

If you genuinely want to engage in a discussion rather than just post links, please move this to the more recent post on this issue.