You are currently browsing the category archive for the ‘Central Banking’ category.

I have not had much to say here over the last few weeks as work has been pretty intense. In the mean time, for those of you more interested in monetary questions, head on over to the Daily Kos for a good read on Hayek vs. Keynes.

Great quote from the piece – “Trying to cure a recession with more cheap credit is like trying to cure chemotherapy with more cancer.

I have been asked several times for a summary of what I think about the changes to the US banking system mooted by the Obama administration. Apart from not actually addressing the root cause of the collapse I believe the suggested changes will just make the whole thing more likely to recur next time the economy downturns.

The root cause, by the way, was over-lending by small commercial banks for mortgage purposes, aided and abetted by Fannie Mae, Freddie Mac, US regulations and bigger US banks that did not look too closely at some of their risk models in pursuit of short-term profits.

The best summary I have heard, though, and one that is close enough to my own views, is this one from the BBC, which I heard driving home yesterday. Give it a listen and then think about it.

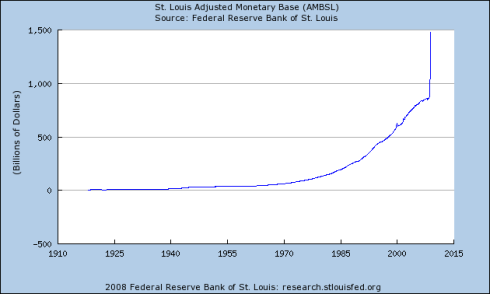

Following on from this post nearly a year ago I thought an update may be of interest.

Clearly, the situation has not improved greatly since then and the reservations I expressed about this last year are still relevant today – but if this story proves correct it may be that the situation is to be resolved at least in the short run. At least it has not got notably worse.The thing with the reverse repos, though, is that the money will eventually re-emerge into the systems as the deal(s) unwind, so this is only a temporary cut. Additionally, the paper that the fed would be issuing (if this is correct) will also normally be negotiable, so this is not as real a cut as it looks.

I am not sure if they intend to keep it that way (i.e. eventually allow all of that cash from the unwound repos to go back to the banks) or if they will be looking to unwind the position completely and return the monetary base to trend – i.e. about USD900bn, representing a long term withdrawal of about half of the current amount.

Either way, it looks like the gigantic experiment is set to continue for a little while yet – just with a little pause.

As for Australia – we could, by comparison at least, be said to be models of conservatism in monetary policy.

This so-called “new” regulatory “system” for the US – at least on the first draft – looks like it is simply going to add a few more regulators into an already over-governed financial system. Adding in more regulators to a system in which, even at the lowest count, there are more than 54 I cannot see as an improvement. From prior experience all I can see it doing is increasing the amount of buck-passing, adding yet another reporting layer and making it even less clear than it already is as to who it is a given financial institution has to listen to.

If you are going to have a regulated system at least make it bloody clear who is responsible and then give them the powers to deal with most, if not all, problems. Then trust them to do their jobs – i.e. get out of the way.

The Australian example is a good one – the government delegated regulatory powers to APRA. There is little doubt over who regulates what – in Australia APRA deals with systemic and individual financial institutional risk – banks, insurers, the lot. The ASX deals with listed companies where it has anything to do with information to shareholders. ASIC deals with companies and any non-APRA regulated small financial entities. The individual States have some responsibilities with respect to consumer protection. AUSTRAC deals with money laundering and some elements of criminal behaviour. The Federal Police deal with other alleged criminal activity.

Even that takes a while to say – and does leave some overlaps, but it is nothing compared to the situation in the USA. At least I can get most ofthe Australian system into one paragraph.

I have always thought the correct way to deal with a mess was to tidy it up. The suggested system seems to amount to clean up a mess by throwing more rubbish on it. It is an innovative solution to the problems – but I cannot see it as brave, useful or intelligent. The US has only just sorted out how to go to Basel II – it has not yet been implemented.

If I can put in my suggestion – other than a free banking system (unlikely to be politically possible) the best solution would be fairly simple. Make the Fed responsible as the sole regulator of all non-State chartered financial institutions, insurance and banking alike. Close the FDIC and allow private sector insurers into the market. Close the OCC and all of the other parts of the alphabet soup that are currently failing to do their jobs.

Close down Fannie, Freddie, Sallie, Maggie (or whatever the rest are called) and the rest – if they need a federal guarantee (implicit or explicit) to do their jobs then they probably should not be doing it. Sell off all of their assets and then the US government makes good on all outstanding liabilities – and the shareholders lose their holdings unless by some miracle they are actually worth something.

Replace US accounting standards with proper ones – IFRS will do. The Fed then implements Basel II the way they wanted to do it (which is also the should be done) – not the half-arsed way they have had to do to get it past the FDIC.

Get all that done and you would have a “New Regulatory System” – and one you could be proud of. As it is you are just going to make a bad situation worse.

Finally: a regulator who has the good sense to see that there is a direct correlation between the intrusiveness of the regulation and the extent of the impact of the current market situation.

Don Brash is a former Governor of the Reserve Bank of New Zealand, who, along with Australia is one of the systems to have had few problems recently.

In many ways, this intensive supervision by official agencies made matters worse by leading bank customers to assume that banks were effectively “guaranteed” by Government, thereby enabling banks to operate with levels of capital well below those regarded as prudent in earlier decades. Perhaps even more serious, intensive supervision led some bank directors to suspend their own judgment, and believe that they were behaving prudently provided they were observing all the rules.(my emphasis)

Hat tip – Jason Soon

Regular readers would know I am not the biggest fan of looking at the money supply and trying to work out inflation or indeed almost anything else from it. I am also not in the habit of getting specific about anything other than banks and regulators. In the US, though, the Fed is both a bank and a regulator and the position they have adopted with regard to the US money supply over the last 6 to 12 months, though, has become ridiculous.

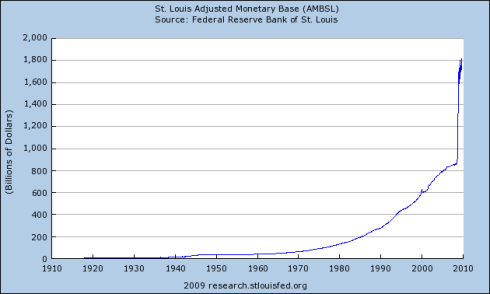

A look at this graph, from the St. Louis Federal Reserve, makes the situation plain.

This cannot be a good thing. Measured money supply has almost doubled over the last 12 months – almost equalling the entire growth over the period covered by the graph in the space of less than a year. It just seems to be experimenting with the entire US economy.

Not being an economist I have no real idea of the effects – but it just looks wrong. I hope most of that is just sitting in bank vaults and not being spent. If so, it should not do too much damage and can be soaked back up by the Fed next year. We’ll see.

UPDATE

I have been pointed at this post, which suggests that the reserves are, as I thought, just sitting in bank vaults – or, possibly, on deposit with the Fed itself. If so then this is less likely to affect the real world. Either way, though, it is very, very, unusual. I am sure there will be whole books written on this period for decades to come – along with some serious revision of economics texts.

I was re-reading last week’s The Economist last night when I happened across the Buttonwood column that I had missed on my first pass. The title, “Heart of Glass” was not promising, but the tagline was very interesting – “Existing regulation seems to encourage banks to get into trouble“.

Buttonwood makes the very valid point that, despite often being derided as the “Wild West” operators, the hedge funds have come through all this (so far at least) without too many major losses. Only a very few have failed (I can think of only one so far, although I am sure there are more) and there have not been many major losses announced.

Banks, on the other hand, have not had a good record. Apart from actually being behind much of the lending that actually caused the issues in the first place the big losses also seem to be concentrated there – just not in the banks that originated the loans. The question Buttonwood asks, but ultimately shies away from is this – is this despite, or because of, the regulations?

Buttonwood puts it this way:

This suggests two main possibilities. Either the standard of bank regulation is very poor or there is something about being regulated that leads to trouble.

The answer from Buttonwood is that it is both – but clearly puts more weight on the first. I would, respectfully, disagree on where the weight should lie.

There are many faults with bank regulation around the world – Basel

I, for example, I regard as having improved matters to the extent it was

global, but made matters worse by its reliance on simple rules – for

example that a loan secured on residential real estate shall attract a

50% weight – regardless as to whether it was super-prime, prime or

sub-prime. It also created strong incentives to “game” the system by the

“originate and distribute” model that really gave rise to

securitisations. This gave a logical reason why a bank may choose to

eliminate assets from its balance sheet (other than the possibility they

were bad assets) and the market for these assets grew – and ultimately

the market got fed some rubbish oops, I mean high-yield assets.

Basel II,

particularly the Advanced methodologies, is much better in that economic

capital is much closer to regulatory capital – a point I have made many

times. It is, however, nearly impossible for smaller banks to implement

and most regulators have also said that, to an extent at least, Basel I will effectively continue to apply for a while through the capital flaws floors.

The incentive to game the system, then, will continue, particularly for the banks going Standardised. There are also many other examples of regulations that, while possibly carefully thought out, end up causing many more problems than the one they were originally designed to stop (submissions invited in comments).

Buttonwood’s proposed solution is, essentially, to re-introduce the US Glass-Steagal Act of 1933, essentially separating commercial banks (that interact with the general public) and investment banks (that do not). The commercial banks would attract a government guarantee and the investment banks would be free to fail. Entities like Citigroup would have to break themselves into two.

In the (probably too many) years I have been dealing with bank regulation I have seen it fall into several categories – ranging from the ones that simply mandate what would otherwise be common sense to the merely annoying to the outright catastrophic. The last ones tend to be introduced and then pulled pretty quickly.

Some of it is needed for legal or criminal purposes – AML/CTF falls into this category. For the rest I would like, as I have said earlier, to see the regulation substantially removed (or at least pared back) and solutions other than a single monolithic regulator for each country to be tried. If a single regulator gets it wrong now the whole system is at risk until the government rides in on its White Charger – see Northern Rock. A truly competitive system would not allow a single regulator to have that much downside on its failure.

Today’s BIS email was an interesting one in the light of recent events. It has a speech

by Christian Noyer, the Governor of the Bank of France, regarding Basel

II’s implementation in France. Remember while you read it that a

certain trader’s activities would have been classified as an operational

risk loss.

This passage is interesting in the light of the problems at SocGen:

By 31 December 2007, over 30 on-site inspections will have been conducted in 20 institutions, involving at times up to 100 inspectors at a time. These on-site inspections examined IRB systems for credit risk and advanced operational risk measurement approaches.

As SocGen is one of the largest banks in Europe I am presuming that

they were one of the banks visited – I think this a safe assumption.

This means that SocGen was assessed for operational risk issues while

all of the rogue trading activities was going on – the trading that was

risking much more than the capital of the bank.

He goes on to say:

…and 5 institutions (accounting for almost 60% of the total assets in the French banking system) are expected to adopt an advanced operational risk measurement approach. As institutions have the possibility under Basel II of using their IRB approaches to calculate regulatory capital requirements, supervisors must ensure that these approaches are reliable.

I really wonder how reliable the regulators found SocGen’s risk

management to be in their supervisory visit? How closely did they look?

You would have thought that the trading arm, where most, if not all of

these events have historically happened, would have been a primary focus

of that review. What did they see?

At the very least, SocGen will probably have to carry a much heavier

operational risk capital burden now than they would have originally

calculated less than a month ago. I think the BoF will have to have a

bit more to say on this in the not too distant future. Who is next in

line to resign over this? They may not be at SocGen.

[Update]In the light of the latest revelations – see here it looks like a lot more than a single trader should lose his job. It looks like senior management were turning a blind eye to the trading while it was making a profit and only got concerned once it was making a loss. If so, it would make the criminal charge hard to sustain.

There is a lot more to come from this one…[/Update]

On question that often arises from situations like the recent, unusual, drop in US interest rates and the stimulus package to support the markets is one of moral hazard. Simply put, the question is whether the tendency of the monetary regulators to respond to widespread market drops with action to push more cash into the system creates moral hazard – a willingness to take more risk in the knowledge that the US Fed (for example) will ride in on a White Charger and help.

My answer is that routine “While Charger” action certainly does create the impression that the “Greenspan Put” is a way out of bad decisions – there is always in the back of the mind the thought that the regulators will act to stop “long-tail” events.

Does this impression actually show through into the real world, though? As the market is really a series of micro events that go to make up a macro picture I would doubt it would have a large impact. To put it another way – will the thought that the Fed may act to bail out the market change the way an individual bond issuer or buyer behaves? If I am considering changing a bond position worth maybe a few million I am really going to consider the possibility of an industry wide bailout if an entire class of assets heads south? Will the thought that the Fed will change rates in the event of a general collapse change the way I trade?

Personally, I doubt it. The individuals actually trading can never really tell whether their position is going to be one of those actually rescued by a general interest rate drop or other action. The only point where this may become a thought is where there is already a widespread drop – but in this circumstance the action would be to point the dealers out of the drop, not into it.

That said, it may affect the risk appetites of the largest of players such as the really big banks, so there is certainly a risk of it. I just think it is overstated by people who look at the macro effects of moral hazard and think that the markets act as some sort of a collective intelligence, rather than looking at it as a series of micro events, which, in reality, it is.

Report in the BBC today saying the British government is about to nationalise Northern Rock. This was probably inevitable after the search for new owners failed. The loss of confidence in the name of the business meant that getting new depositors to replace the old, without a complete change in ownership, was always going to be impossible.

What will happen now looks fairly clear – the government will pass a bill, the doors will shut to new business and current depositors will walk away. Mortgage holders will be encouraged to refinance elsewhere. This will both increase the exposure to the government and reduce what value is left to pay out to shareholders, if any.

Really, it should have been allowed to fail. As my several posts on this situation have made clear, this would have resulted in the business closing, the depositors paid out a reasonable amount at first and then all of it (including interest) over time. Shareholders would then have got a return out of the residual funds – which there would have been. The FSA’s deposit insurance scheme would have been up for some payouts, but they would have recovered it all. The only (minor) losses would have been to shareholders.

Admittedly, this may have caused worries about other institutions – but none was in a position like the Rock and this could have been made clear.

The real panic here was from the regulators and the government, who were blind-sided by something they probably believe they should have spotted.

Most popular