You are currently browsing the category archive for the ‘Market Risk’ category.

One thing I noted during a look through all of the major banks’ APS 330 disclosures is that the view of risk they took was completely one sided. For example, in the market risk disclosures VaR exceptions were reported as if the only exceptions were the downside ones – if the bank made money on the day it was not an exception even if it was outlide the VaR limits.

One thing that the episode with the NAB in 2004 should have shown is that you need to investigate the good stories as well as the bad ones – a point driven home by Bernie Madoff recently. The money quote from the Forbes article is correct –

It’s virtually impossible to have returns like Madoff reported, and it should have been a major warning signal.

It should have been, but it was not as few people cared to look at the signal, as a one sided view of risk is common.

Looking at APS 330, though, I think the view they have taken of the disclosures is actually not following the Standard and is likely to encourage risk taking activity. Not, of course, that I think that any of the banks here are running any rackets like Bernie’s.

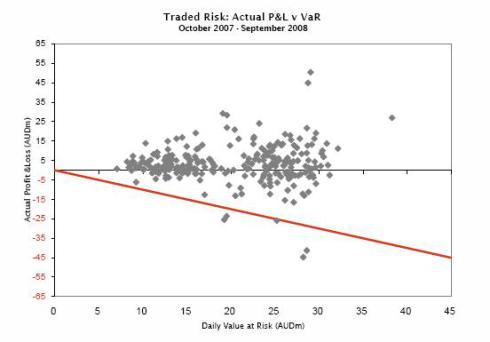

For example, if you look at the Westpac disclosures under APS 330 you see the same sort of view of risk1.

See that red line going down at an angle? This implies that it is only a VaR breach if there is a loss. There are, however, at least four (and maybe a further one) more sitting above where a line would have been if a line were drawn above the x axis to mirror the red one that is there. See them? There are two where the daily VaR was AUD20m, with returns of around AUD30m and a further two where the daily VaR was AUD30m but the returns were about AUD45m and AUD 55m. The AUD55m one is in fact the biggest VaR breach the bank had. The further one is (I think) at the daily VaR of AUD10m, with a return that looks suspiciously like AUD15m.

If those are not VaR breaches then I know little about what VaR is. But that’s OK, isn’t it? The bank made a profit.

Umm, no. APS 330 is clear if you look at page 19. Table 11(d) calls for:

…a comparison of VaR estimates with actual gains/losses experienced by the ADI, with analysis of important ‘outliers’ identified in back-test results.

Nowhere in there does it say that the outliers are only to be the downside outliers. Table 11(b) may allow the regulator to approve this interpretation and it may be that APRA have allowed them to ignore the upside outliers, but if this is so then APRA is endorsing this.

I am not sure which is worse – the Bank ignoring VaR breaches of the possibility it is under instruction from the regulator to do so. I just hope they are not reported internally like this.

In any case, may I cordially suggest that this not continue. A VaR breach is a VaR breach and should be treated as such, positive or negative. Risk is double sided – high returns normally come with high risk. A failure to investigate a high return encourages traders to take more risks and there are many trading departments where a disasterous loss has been heralded by an impressive gain.

Just ask Nick Leeson, Gianni Gray, David Bullen, Vincent Ficarra and Luke Duffy, amongst many others.

1. I am picking on them as the data on this for them is at least public. I have no idea what it is for the others.

Market risk is the oldest part of Basel II, being substantially

unchanged from the 1996 (1998 implemented) market risk amendment to the

original Basel I Accord. As such, the “Big 4” have all been using these

methodologies for about a decade. All that really changed with Basel II

was the addition of Pillar 3 – these disclosures. As such, you would

expect that these should be the clearest disclosures as the underlying

systems and processes are very well understood.

Over the last year, though, this area has probably undergone the most

change, both globally and in Australia due to the market turmoil. The

VaR numbers have probably moved enormously, particularly over the last

few months as some of the extreme movements have come through to the

modelling.

That makes the disclosures of great interest – the only real problem is

that they are effectively two months out of date when they come out –

except in the case of the Commonwealth, where they were five months out

of date.

Qualitiative Disclosures

These range from the almost insultingly short (that’s you, Westpac) to the sorts of disclosures that probably come close to best practice (thanks – CBA again). The CBA diagrams could be used as slides in a presentation and the text used to read out at that presentation. They are that good.

In reverse qualitative order, then:

Westpac

Westpac has kept them as short as is humanly possible while still maintaining compliance with APS 330, provided you use a generous interpretation of what “describe” means. For example, I do not see this desciption of backtesting as in the spirit of comprehensive disclosure:

Daily backtesting of VaR results is performed to ensure that model integrity is maintained. A review of both the potential profit and loss outcomes is also undertaken to monitor any skew created by the historical data.

That’s it – the entire description of their backtesting regime. The descriptions of stress testing and everything else are equally short. If you are looking for which disclosures to use as an example of best practice under Pillar 3, well, you would not use these unless you are attempting to work out how minimal your compliance needs to be. If you want to know how Westpac actually goes about managing these risks then using these disclosures will not be an appropriate place to start.

Score – 1 out of 5 as it does comply with the standards. Sort of.

ANZ

The ANZ is slightly better than Westpac – but still on the marginal side of good – with just a brief description of internal processes and a little bit better description of things like backtesting. At least they are using some hard numbers for what a backtesting exception is, even if they give no examples. Westpac at least beats them here – but only with a diagram that really tells you very little. Again, do not use these to find out what the ANZ is up to or how it really manages its risks.

2 out of 5.

NAB

The NAB is appreciably better in all areas than either the ANZ or Westpac, with some real disclosures of how they manage the market risk processes. The chart of backtesting results, with actual dates on it, represents a form of disclosure that gives me some confidence that they are actually managing the risks. Given the problems that the NAB have experienced in this area over the last few years, I am happy to see this. Their stress testing description, for example, while not exactly adding to the published literature is actually usable.

3 out of 5.

Commonwealth

The guernsey for the best disclosures go to the Commonwealth (again). The diagram on the first page of those disclosures, by itself, beats anything that either Westpac or the ANZ has put out. Read on and it just gets better. For example, not only have they put in a table giving each and every day over the period where backtesting exceptions occurred, but they have added the hypo loss and VaR numbers for each of those days. They have also named the functions responsible for each of the areas of risk and have added their reporting lines and some of the delegations.

4.5 out of 5 – but only because I like to leave some room for improvement.

Quantitative Disclosures

The important numbers here are the VaR numbers – but these cannot be directly compared as each of the banks has their own, differing, portions of their portfolio covered by the Standardised method – i.e. they are not included in the published VaR numbers, even if they are modelled internally using VaR. The other problem is that CBA’s numbers are as at 30 June and the others are as at 31 September. Given the increased volatility over those three months, the CBA numbers would have increased.

With those caveats, though, the capital numbers1 in both alphabetical and size order are:

- ANZ: $175m Standardised and $34m IMA

- CBA: $225m Standardised and $135m IMA

- NAB: $274m Standardised and $133m IMA

- WBC: $291m Standardised and $234m IMA

While fairly small in the context of each of the banks, these numbers are intersting in themselves, with WBC being by far the largest and the ANZ the smallest. Given that, it is doubly disappointing that WBC chooses to say the least.

1. They are buried in differing ways in each of the disclosures, but this is my calculation from the published numbers

Most popular