You are currently browsing the monthly archive for October 2009.

Following on from this post nearly a year ago I thought an update may be of interest.

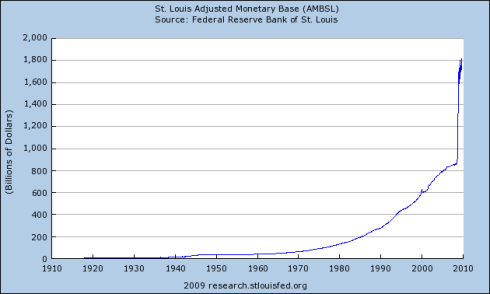

Clearly, the situation has not improved greatly since then and the reservations I expressed about this last year are still relevant today – but if this story proves correct it may be that the situation is to be resolved at least in the short run. At least it has not got notably worse.The thing with the reverse repos, though, is that the money will eventually re-emerge into the systems as the deal(s) unwind, so this is only a temporary cut. Additionally, the paper that the fed would be issuing (if this is correct) will also normally be negotiable, so this is not as real a cut as it looks.

I am not sure if they intend to keep it that way (i.e. eventually allow all of that cash from the unwound repos to go back to the banks) or if they will be looking to unwind the position completely and return the monetary base to trend – i.e. about USD900bn, representing a long term withdrawal of about half of the current amount.

Either way, it looks like the gigantic experiment is set to continue for a little while yet – just with a little pause.

As for Australia – we could, by comparison at least, be said to be models of conservatism in monetary policy.

I will very irregularly have any time for a full post over the next few weeks due to work pressures. I seem to be spending most of my time here trying to sort out one commenter on what I believe to be his misunderstandings of banking. Oh well.

Just for your reading pleasure, though, I read a very good post regarding the role and future of the Credit Ratings Agencies on the usually excellent “The Sheet” today. Have a read – it is worth it.

Conclusion:

The agencies proved that they are poor at rating complex structured finance products. Their approach to rating sub-prime mortgage backed securities was not sufficiently rigorous and their models for assessing other more complex products were inadequate.

By virtue of this, their opinions on these products should now be viewed as being of little value and the market should effectively withdraw the agencies’ ‘licence’ to rate such products. This will open the door for new specialist structured finance ratings agencies to enter the market.

This seems a better approach than more regulation and the unintended consequences that could result.

If you are in the business of reading banking news on a regular basis please subscribe. It may help in your understanding of what banks actually do.

Most popular