You are currently browsing the monthly archive for January 2009.

I have spent the last few days looking at a client’s Excel spreadsheet. They are using it to manage all of their treasury positions – amounting to several hundred million dollars.

Don’t get me wrong – Excel is a wonderful tool, but under normal circumstances this is probably not the optimal choice to make. In their case there are some exceptional circumstances that means that this may be a reasonable (if short-term) solution but it prompts me to ask if anyone has a favourite MS Excel story.

My personal favourite is of a former employer of mine in London. They are a major investment bank that is also one of the largest commercial banks in their home country. In short, a huge operation with assets in the hundreds of billions of pounds.

When I joined them in the late 1990s, they had acquired many other banks and trading operations over several years, including the one that I was formerly employed by. The problem was that each of those entities had their own general ledger and the bank had not taken steps to integrate or eliminate them at all.

The problem should be obvious – there was no one place where the bank’s general ledger was kept. The solution adopted was a classic one. At the end of every month a full ledger dump was taken from each GL and integrated using Excel – with all of the problems of GL account mapping and consolidation to deal with. The time taken to close off the GLs, get the dump, process it and then put put the management reports out meant that, at best, it took until mid-month to get the numbers. Control was effectively impossible.

After a year of this, it was decided that a better solution was needed – besides which the 65,536 row limit was being breached and the speadsheets took hours to recalculate. The solution? MS Access. When I left that had eventually moved on to SQL Server – but it was still taking nearly the same amount of time to get everything done.

Internal audit always paid close attention, but the risks were always just huge. There was also no real way to verify any of the numbers other than tracing each one back to the host systems and that could take hours per number.

The new paper from the BIS on stress testing looks to be an important one. I have not had a chance to go over it in detail yet, but if you are in this area it is one you should read urgently. I would also add that much of this is likely to be incorporated in the next version of the Accord.

I will put together some comments on it over the next week as time allows.

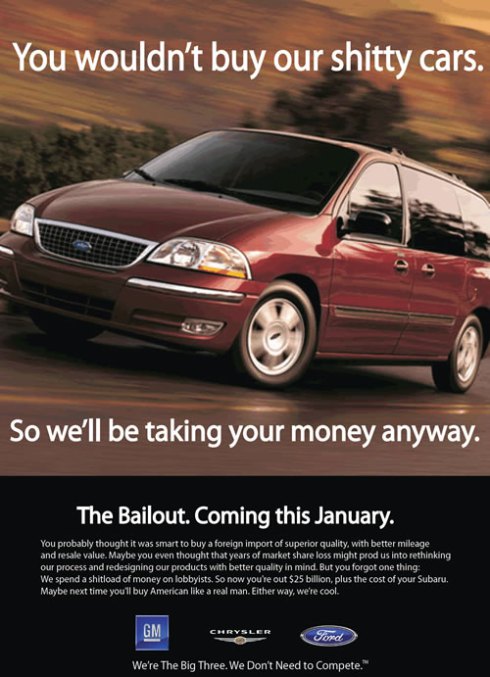

I normally try to avoid commenting on non-banking industry matters, but since the funds for the big three carmakers are coming from the US TARP program I think it may be legitimate. In any case, this advertisement is probably the best comment I have seen on this part of the bailout:

This one deserves maximum coverage as it hits the nail on the head. If you know of any similar ones, add them in comments.

Most popular